It is virtually defined because of the reality of the price one must spend on acquiring a few components. As the prominent announcement goes, “it charges coins to make coins.”

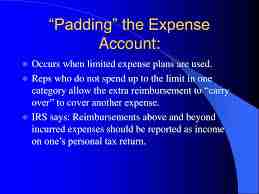

Common expenses include vendor payments, employee wages, manufacturing unit rentals, and system depreciation. Businesses can write down tax-deductible charges on their earnings tax returns to lower their taxable profits and, subsequently, their tax felony obligation; however, the Internal Revenue Service (IRS) has strict recommendations on which expenses corporations are allowed to say as a deduction.

A price is the price of operations that an organization incurs to generate sales. It is defined due to the fee one wants to spend on acquiring a few components. As the prominent announcement goes, “it prices coins to make cash.”

Common fees include company payments, worker wages, manufacturing facility leases, and machine depreciation. Businesses can jot down tax-deductible expenses on their profits tax returns to lower their taxable profits and, as a result, their criminal tax obligation; however, the Internal Revenue Service (IRS) has strict regulations on which costs companies are allowed to claim as a deduction.

What Is Not An Expense Account?

Expense payments are a common part of business enterprise and may be used to help control fees. But what exactly is a free account? And extra importantly, what needs to be considered as a free account? In this blog submission, we’re able to discover the most effective of a kind style of money owed you may use in a business agency, in addition to what is not considered a cost account. From tour fees to enjoyment expenses and extra, observe immediately to discover how you can first-rate manipulate your price range.

What is a cost account?

A price account is an accounting approach in which fees are charged to a selected account instead of being lumped together with different working fees. This offers greater transparency and helps managers higher manipulate spending more.

Typically, each charge has its very personal account, collectively with adventure, workplace substances, or advertising. This allows groups to music how much they spend in every location and make adjustments as needed. For instance, if an agency sees that it’s spending too much on place of work materials, it can take steps to lessen or discover cheaper alternatives.

Expense money owed also can help organizations hold tabs on employee spending. For example, suppose a worker regularly submits costs for food at the same time as visiting an organization. In that case, the enterprise can also query whether this is necessary or whether or not or now not the worker is abusing the device.

Fee debts offer companies greater insight into their spending patterns and allow them to make extra informed selections approximately wherein to allocate their property.

Expenses

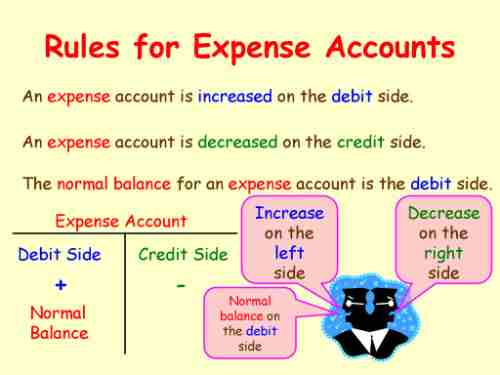

Are searching for advice from expenses incurred in carrying out commercial agency. Technically, charges are “decreases in financial benefits throughout the accounting duration in the shape of decreases in property or will increase in liabilities that bring about decreases in equity, aside from those referring to distributions to equity members.”

Expenses Explained

From the technical definition of rate, we are capable of drawing the subsequent factors:

Decrease in blessings sooner or later in the accounting period – Expenses are measured from period to period and affect a decrease in financial blessings.

Decrease in assets or growth in liabilities: The lower economic advantages cited above may be a decrease in property or a boom in liabilities. When a business enterprise corporation incurs a charge, it could pay coins, thereby decreasing property. Besides coins, the enterprise might also use unique assets in paying expenses. It may also incur liability in accumulated costs (unpaid prices).

Decrease in equity, apart from distributions to equity contributors – There are only factors that decrease fairness: distributions to proprietors (i.e., withdrawals or dividends) and costs.

What is a fee account?

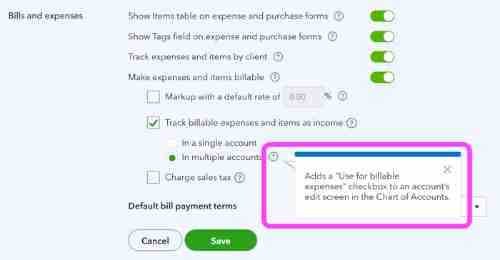

A charge account allows you to sort the numerous costs your industrial organization has in the path of a term. Expenses in a fee account are stepped forward via debits and reduced with the aid of credit usage. Your fee account increases while you spend money. Expense money owed is considered quick debts, which means they reset at the same time as a new length starts.

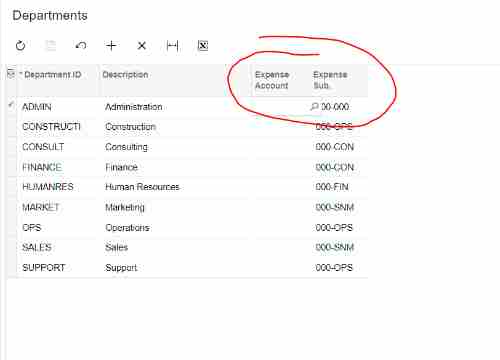

Break down your value account into smaller sub-money owed. That way, you can examine the costs you spend most on better music, coins, and organized life.

Sub-debts listing out how a top-notch deal you spend on every shape of charge. You can create sub-money owed for your prices, like payroll and marketing.

Your charge account wants to encompass balances for every sub-account further to whole value stability.

Expense money owed differs from the handiest money owed you need to music. A free account is one of the five necessary amounts of money owed covered in an organization’s chart. The wonderful middle payments are:

- Assets

- Liabilities

- Equity

- Income or revenue

While reading the above list, you could have needed clarification about the difference between prices and liabilities. Liabilities are unpaid costs that you owe to organizations, personnel, or remarkable entities.

Understanding Expenses

One of the principal dreams of organization management agencies is to maximize income. This is accomplished through boosting sales whilst maintaining fees in the test. Slashing expenses can assist businesses to make even extra money from income.

However, if charges are lessened, an excessive amount of it can also have a dangerous effect. For example, paying less on advertising reduces charges and lowers the organization’s visibility and capacity to acquire capable customers.

How Expenses Are Recorded

Companies damage their income and prices in their income statements. Accountants report prices via one among two accounting strategies: cash basis or accrual basis. Under cash foundation accounting, charges are recorded while they’re paid. In evaluation, charges are recorded below the accrual technique while they are incurred.

For instance, if a business owner schedules a carpet cleaner to clean the carpets inside the workplace, an enterprise using the coins foundation statistics the price at the same time as it may pay the bill. Under the accrual method, the company accountant should report the carpet cleansing price at the same time the commercial business enterprise agency receives the carrier. Expenses are normally recorded on an accrual basis, ensuring that they match the income noted in accounting periods.

What Are the Benefits of Having an Expense Account?

There are several reasons why you should have a free account. First, accounting books must hold a price account to stay in jail. All organization costs ought to be recorded consistent with accounting ideas. As such, you surely must have a free account.

The biggest benefit, except maintaining legality, is the company. The organization is one of the most critical abilities for any commercial organization owner. While you may have a generalized fee account, the maximum people select is to break their debts down. This improves agency drastically. It moreover permits greater budgeting.

When you track your prices, you can plan how to spend your coins. You’ll be capable of awaiting future prices. For example, if you realize you were given an annual charge at an equal time every twelve months, you can plan for that. Try this, even though it is through tracking your special prices.

Expenses in Cash Accounting and Accrual Accounting

Expenses are recorded within the books on the accounting device selected with the corporation’s useful resource, every via an accrual basis or a coins foundation. Under the accrual technique, the charge for the nice or employer is recorded while the jail obligation is whole; this is at the same time as the goods had been obtained or the carrier has been completed.

Under coins accounting, the cost is greatly recorded at the same time as the actual cash has been paid. For example, a software program application charge incurred in April, paid in May, is probably recorded as a fee in April below the accrual approach but recorded as a May fee beneath the coins technique – as that is while the cash is, in truth, paid.

Accrual accounting is primarily based on the matching principle, which guarantees that correct income is contemplated for each accounting length. The revenue for each duration matches the expenses incurred in earning that sale by a few degrees in the same accounting period. For instance, sale fee costs may be recorded inside the length that the associated income is referred to, regardless of at the same time as the fee changed into virtually paid.

Cost of merchandise supplied

The value of merchandise provided (COGS) is the amount a commercial organization spends on obtaining the uncooked substances that the organization converts into finished devices and offers for profits. COGS does not encompass any unsold inventory at the forestall of the accounting period. Moreover, it might no longer encompass administrative expenses or funding and interest losses, as you normally subtract those fees from its calculation.

Various agencies call COGS otherwise. If the commercial business enterprise offers a company in the vicinity of manufacturing a product, the rate of products supplied becomes the fee of offerings. Companies that manufacture gadgets and offer offerings concurrently speak over with the COGS due to the charge of income.